are property taxes included in mortgage in texas

However you have until January 31st to pay without. Homeowners are responsible for paying their property taxes directly to the.

Escrow Account Basics Texaslending Com

Some lenders may include property taxes in the mortgage while others may not.

. Property taxes are included as part of your monthly mortgage payment. It is advisable to check with the lender to find out their specific policy on this matter. It may be as much as 140 of total property taxes.

There is no exact value for all homeowners. If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480. These taxes are usually between 21 and 368 per 100 assessed value.

For example on a. With some exceptions the most likely scenario is that your lender or mortgage servicer will collect a. As with property taxes you pay roughly one-twelfth of your annual premium each month and the servicer pays the bill when its due.

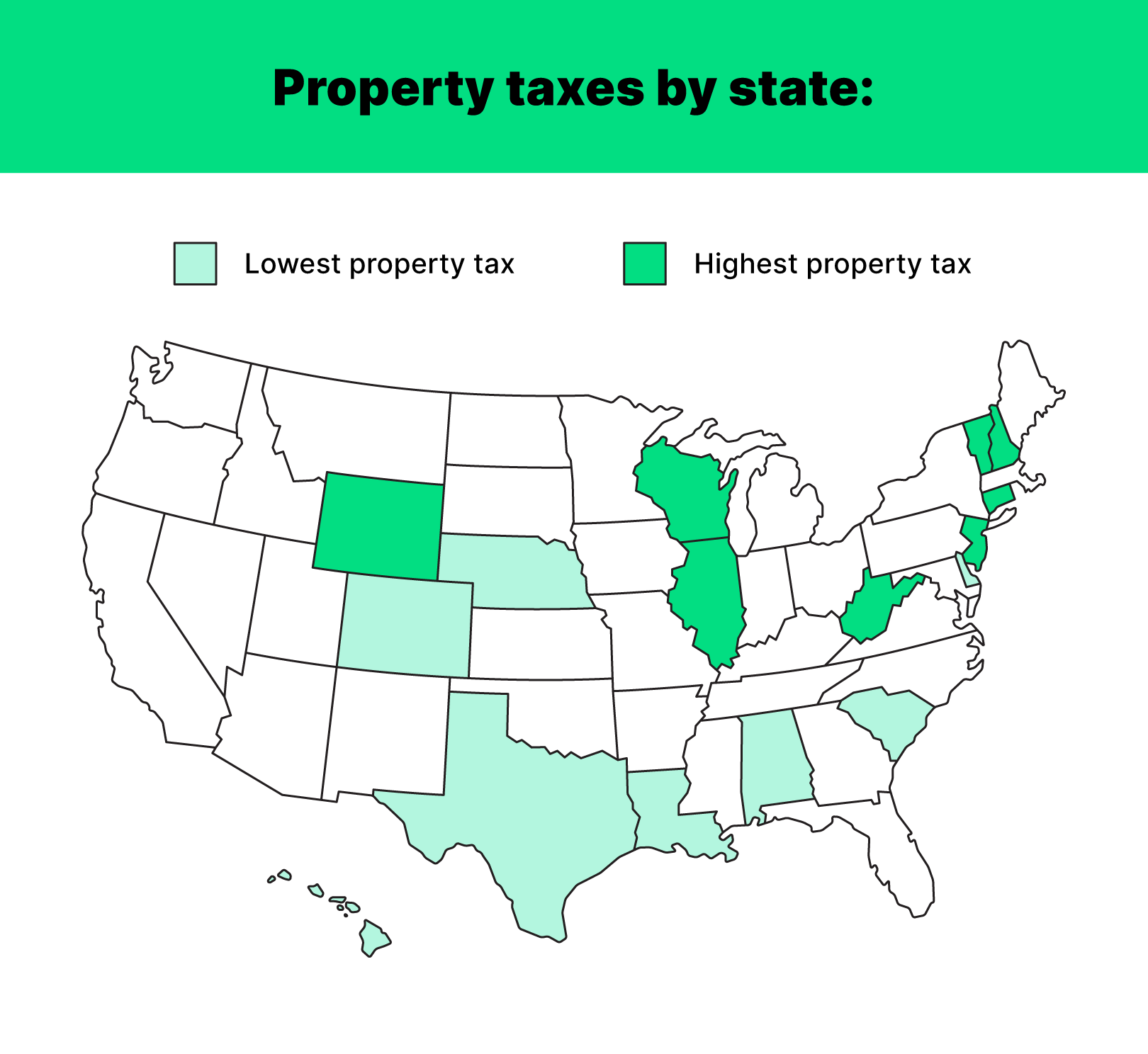

Technically your property taxes are due as soon as you receive a tax bill. Property taxes in Texas are known for being quite high compared to the rest of the country. The new Tax Cuts and Jobs Act took effect on January.

If your down payment is less than 20. First if you have a down payment of less than 20 you wonât have enough equity in your home for your lender to consider allowing you to pay your property taxes yourself. 21 Are property taxes included in mortgage in Texas.

Property taxes are included in mortgage payments for most homeowners. Its one of the first things to add to your housing. However it is generally speaking property taxes are not included in the mortgage payment in Texas.

If you dont you put yourself at risk of mortgage liens or foreclosure. The final Texas property tax due date is January 31st every year. 254 rows Factors in Your Texas Mortgage Payment Property taxes in Texas are known for being quite high compared to the rest of the country.

If you qualify for a 50000.

Your Guide To Property Taxes Hippo

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

If You Own A Home In Texas Make Sure To Pay Your Property Taxes To Avoid Piles Of Penalties Wfaa Com

How High Are Property Taxes In Your State Tax Foundation

Georgia Morales Realtor W Texas Bound Real Estate The U S Tax Code Lets You Deduct The Interest You Pay On Your Mortgage Your Property Taxes And Some Of The Costs Involved

Are Property Taxes Included In Mortgage Payments Sofi

What Am I Paying For With My Monthly Mortgage Payment

Homestead Exemptions In Texas How They Work And Who Qualifies Trinity Oaks Mortgage

Texas Homeowner Assistance Fund Cameron County

Are Property Taxes Include In Mortgage Payments How The Bill Is Paid

Is Property Tax Included In My Mortgage Moneytips

How To Use A Mortgage Calculator With Taxes In Texas

How Long Can You Go Without Paying Property Taxes In Texas A Guide To How Long Property Taxes Can Go Unpaid In Texas Before For Foreclosure Tax Ease

/https://static.texastribune.org/media/images/PropertyTax.jpg)

Property Tax Lending Industry Under Review Again The Texas Tribune

How To Use A Mortgage Calculator With Taxes In Texas

Mortgage The Components Of A Mortgage Payment Wells Fargo

Who S Responsible For Property Taxes On A Reverse Mortgage